No Deduction for Business Expenses Paid Out of Forgivable Paycheck Protection Program Loans

June 9, 2020See our most recent guidance on the COVID-19 relief bill here.

On April 30, 2020, the IRS released Notice 2020-32 addressing the deductibility of covered expenses for which loan forgiveness is available under the Paycheck Protection Program (PPP). The PPP, which was implemented as part of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), allows borrowers to receive up to $10,000,000 to fund eligible payroll costs, certain mortgage payments, rental payments, and utilities payments. The loan proceeds used for these purposes during the eight week period following receipt of the money may be forgiven, subject however to reduction if the borrower lays off employees or reduces salaries and wages by more than 25%. While under general tax principles the forgiveness of a loan results in taxable cancellation of indebtedness income, the CARES Act provides that the amount forgiven will not result in income. The IRS, however, effectively negated this concept with Notice 2020-32 by providing that employers may not deduct their qualifying expenses if payment of the expenses results in forgiveness of the PPP loan and the forgiveness is excluded from the employer’s gross income under the CARES Act.

The CARES Act itself is silent on whether otherwise allowable deductions for the payments of qualifying expenses by a recipient of a PPP loan are allowed if the loan is subsequently forgiven. As a general rule, a taxpayer may deduct all ordinary and necessary business expenses paid or incurred during the year. The expenses for which PPP loans may be used, including rent, utilities, mortgage interest, and payroll costs, are all generally considered ordinary and necessary business expenses that would be deductible. Section 265 of the Internal Revenue Code (the “Code”), however, provides that taxpayers may not deduct amounts to the extent those expenses are allocable to tax-exempt income. IRS Notice 2020-32 concludes that, to the extent the CARES Act excludes the forgiven PPP loan amount from gross income, Code Section 265 disallows any otherwise allowable deductions for the payment of expenses for which the PPP loans are permitted to be used.

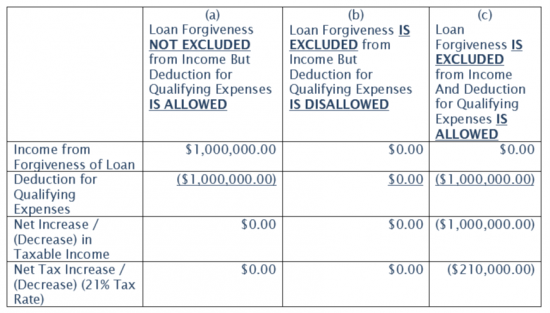

By disallowing deductions for the expenses funded by PPP loans, the IRS has effectively eliminated the tax benefit an employer receives from the tax-free forgiveness of the loan. This can be seen from the following comparison involving a $1,000,000 loan, all of which is used to pay qualifying expenses, such as payroll expenses, using the current corporate income tax rate of 21%.

As this table shows, the IRS decision announcing that deductions are not allowed for forgiven PPP loan amounts eliminates the entire tax benefit of excluding the loan proceeds from income. While having an increased tax liability is better than having to repay the entire borrowed amount, the nondeductibility of qualifying expenses funded by PPP loans significantly limits the benefit of the PPP loan. Column (a) illustrates the income tax consequences pursuant to general tax law principles under which the loan forgiveness would be included in income and qualifying expenses would be fully deductible. Column (b) illustrates the income tax consequences pursuant to the CARES Act and Notice 2020-32, under which the loan forgiveness would be excluded from income but deductions would not be allowed. The tax results in both cases are identical: the net effect on the employer’s taxable income and income tax liability is $0. By contrast, column (c) illustrates the result under the CARES Act if the loan forgiveness is excluded from income but deductions were not prohibited by Notice 2020-32: the employer’s income tax liability is reduced by $210,000. Since the PPP loan program and other provisions of the CARES Act were intended to provide employers with additional liquidity to avoid layoffs, the result in column (c) appears to make more sense from a policy standpoint. Unfortunately, under Notice 2020-32, employers are stuck with the result in Column (b).

This has several key implications for employers considering taking out a PPP loan:

- Employers who obtain a PPP loan cannot claim the employee retention credit under the CARES Act, unless they repay the loan by May 18, 2020. Employers should take into account the denial of deductions under Notice 2020-32 when deciding which of these benefits is more valuable to them. The answer will vary for different employers (and may depend, for example, on the amount of the PPP loan received) and should be analyzed in consultation with a tax advisor.

- Employers who had assumed qualifying expenses funded with a PPP loan were deductible may have to adjust their estimated tax payments accordingly. IRS guidance has deferred the due date for payments of 1st and 2nd quarter estimated taxes for 2020 for many taxpayers.

If you have any questions concerning Notice 2020-32, the PPP, other federal government programs available or the implications and disruptions of COVID-19 on your business, please contact any of the authors above or another member of the Lewis Rice COVID-19 Task Force.