Banking Agencies Issue CARES Act Guidance and Capital Rules

April 7, 2020The federal banking agencies continue to take action to provide flexibility and allow financial institutions to focus on supporting lending to creditworthy households and businesses given the recent strains on the U.S. economy caused by the coronavirus.

On April 6, 2020 the federal banking agencies issued two interim rules that make CARES Act changes to the recently adopted community bank leverage ratio (CBLR) framework. Prior Lewis Rice alerts summarize the CBLR framework and the temporary changes under the CARES Act.

The interim rule temporarily reduces the leverage ratio to 8% (from 9%) but does not make any changes to the other qualifying criteria in the CBLR framework. To qualify for the CBLR framework, a banking organization must meet the following requirements:

- Less than $10 billion in total consolidated assets;

- Total off-balance-sheet exposure (as defined in the 2019 final rule) of 25% or less of total consolidated assets;

- Total trading assets plus trading liabilities, calculated in accordance with regulatory reporting requirements, of 5% or less of total consolidated assets;

- Leverage ratio greater than 8%; and

- Be a non-advanced approaches institution.

Under the statutory interim final rule, a community banking organization that temporarily fails to meet any of the qualifying criteria as set forth above, including the 8% CBLR requirement, will have a two-quarter grace period, as long as the community banking organization maintains a leverage ratio equal to 7% or more. Following the two-quarter grace period, a qualifying banking organization that fails to maintain a leverage ratio greater than 7% must comply with the generally applicable capital rule and file the appropriate regulatory reports. Further, no grace period is available for a banking organization that ceases to meet the criteria based on a business combination (such as the consummation of a merger).

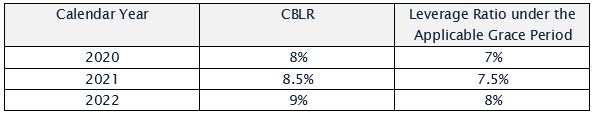

In order to provide community banking organizations with sufficient time and clarity to meet the requirements under the CBLR framework, concurrent with the issuance of the CBLR interim final rule, the federal banking agencies also issued an interim final rule that provides for the transition from the temporary leverage ratio of 8% to the leverage ratio of 9% as follows:

The statutory interim rule will be effective upon publication in the Federal Register, and a qualifying banking organization can utilize the interim CBLR framework for purposes of filings its regulatory reports for the second quarter of 2020 (that is, as of June 30, 2020). The temporary changes to the CBLR framework implemented by the statutory interim rule terminate upon the earlier of the termination date of the national emergency or December 31, 2020.

In addition, the FDIC and the Federal Reserve each released guidance alerting financial institutions of the multiple forms of relief available under the CARES Act through programs administered by the Small Business Administration (SBA) and encouraging financial institutions to consider such programs in a “prudent manner.” Notably, the FDIC and the Federal Reserve each stated that they will not criticize a financial institution’s good faith effort to prudently use the SBA program to work with small business borrowers.

In response to the COVID-19 pandemic, Lewis Rice has formed a COVID-19 Task Force which brings together subject matter authorities from various practice areas within the Firm who stand ready to assist our clients as they navigate these challenging and evolving issues. If you need assistance with compliance, please contact one of the authors above or another member of the Task Force.